Protect your life &

loved ones. we're

here to guide you.

Get insured &

secure today!

Your Trusted Partner in Protection

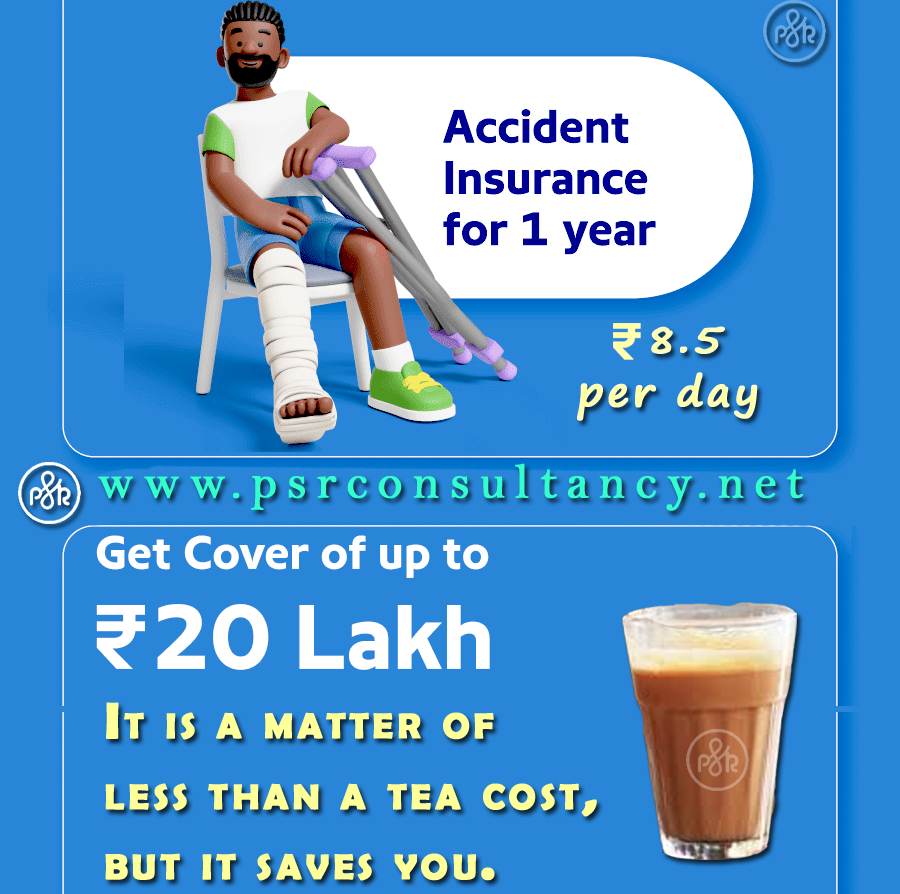

Insurance Expertise you can trust with over 10 years of experience in the insurance industry, I possess a deep understanding of various insurance products and services. My extensive knowledge and expertise have empowered me to deliver tailored solutions to over 500+ satisfied customers, ensuring they receive the best coverage for their unique needs.Let me leverage my expertise to help you navigate the complex world of insurance and find the perfect solution for you.

Get insured today and ensure a healthy and wealthy future.

Call or whatsapp us at 866-813-9841.

risk & financial protection solutions

Protection for Life's Uncertainties, Insure Your Dreams, Today

Life Insurance

"Life Insurance: Provides financial protection for your loved ones in the event of your passing, ensuring they can maintain their standard of living and achieve their goals. Life Insurance Benefits: • Lump-sum death benefit • Income replacement for dependents Life Insurance Solutions: • Customized coverage options • Flexible premium payments • Tax-free benefits • Long-term care & disability riders Don't leave your loved ones unprotected. Contact us today to learn more and get a quote. Our expert team will help you to choose the right Life Insurance Plan & coverage for your family's future."

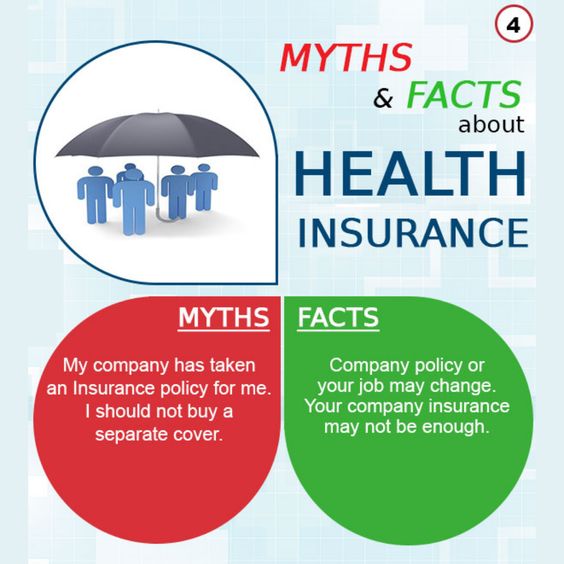

Health Insurance

"Health Insurance: Protecting Your Well-being Insurance provides financial protection against medical expenses, ensuring access to quality healthcare when you need it most. Health Insurance Coverage: • Hospitalization • Cashless Mediclaim • Doctor Visits • Prescription Meds Benefits: • Financial protection • Access to providers • Customized coverage • Additional benefits Protect Those Who Matter Most Contact us today to learn more and get a quote. Our expert team will help you choose the right Health Insurance coverage for your individual or family needs."

Auto Insurance

"Auto Insurance: Protecting You on the Road, It provides financial protection against accidents, damages, and losses related to your vehicle (Bike, Car, Truck, Taxi, Bus and all motor vehicles). Our comprehensive coverage includes: Auto Insurance Coverage: • Liability • Collision • Comprehensive • Personal Injury • Uninsured/Underinsured Benefits: • Financial protection • Customized coverage Don't risk driving without protection. Contact us today to learn more and get a quote. Our expert team will help you choose the right Insurance Premium with NCB coverage for your Motor needs."

Business Insurance

General Insurance provides financial protection against unexpected events and losses. Our solutions cover various aspects of your life and business, including: Insurance Types: • Property • Travel • Business • Other Solutions Risks Protected: • Natural disasters • Legal liability • Business interruptions Don't risk Don't Risk your Financial Future without protection. Contact us today to learn more and get a quote. Our expert team will guide you in choosing the right insurance solutions for your needs."

Travel Insurance

Are you planning a trip abroad? Protect yourself and your loved ones from unexpected medical and travel-related expenses with our travel insurance plans. Our comprehensive coverage includes: Medical expenses for accidents and illnesses Trip cancellation and interruption due to unforeseen events Baggage loss or delay 24/7 travel assistance and emergency services Whether you're traveling for business or pleasure, our travel insurance plans have got you covered. Don't wait until it's too late. Get a quote and buy our travel insurance online today to ensure a safe and enjoyable trip.

Cyber Insurance

In today's digital age, cyber threats are a growing concern for businesses of all sizes. A single cyber attack can result in significant financial losses, damage to your reputation, and legal liability. Our cyber insurance plans are designed to protect your business from these risks. Benefits: Comprehensive coverage for cyber risks Flexible coverage options to meet your business needs Competitive pricing and expert risk management advice Don't wait until it's too late. Get a quote and buy our cyber insurance online today to protect your business from cyber threats.

articles

TERM Insurance எடுக்கும் போது குழப்பமா? உங்கள் மதிப்பு இதுதான்!

Term Insurance Importance: மாற்ற முடியாத துக்கத்தையும் எதிர்கொள்ள தயாராக இந்த டிப்ஸ் உங்களுக்கு அவசியம்! குழந்தைகளின் எதிர்காலம் பற்றிய கவலை உள்ளவர்களுக்கு அவசியமான கட்டுரை.

Why Business Insurance is essential?

Business insurance is crucial for protecting companies from financial losses, managing risks, ensuring legal compliance, and maintaining credibility. It safeguards against unexpected events like property damage, lawsuits, or disruptions, providing financial security and peace of mind. Additionally, it supports employee protection and ensures business continuity, making it essential for long-term stability and growth.

testimonials is actual rewards

Hear from Our Clients

Thanks to their health insurance, my hospital bills were taken care of promptly and I could focus on recovery.

Mrs. NirmalaWorking Women Their auto insurance saved the day when I had an unexpected accident. Highly recommend their guidence!

Mr. SaravananNRI, Software Engineer The life insurance policy gives me comfort knowing my family is secure, no matter what happens.

Mr. MuthuvelPeaceful Father "I highly recommend this company to anyone looking for top-notch insurance solutions!, Kind attention and customized solutions exceeded my expectations."

Mr. Chandrababu KProject Manager, IT I was hesitant to switch insurance providers, but the team made the transition seamless and ensured I had the best coverage for my budget.

Mr. ManivannanPrivate Staff ""I've never felt so secure knowing that my family is protected with the right insurance coverage policy. Thank you for your expertise and guidance!"

Mr. AnburajContractorunclear about what to do next?

Confusion can arise when choosing the right type of insurance.

- 100 Feet Rd, Jayamurthy Raja Nagar, Ozhandai Keerapalaiyam, Mudaliarpet, Puducherry, 605004

+91-8668139841 - A2P Consultant

+91-8668139841 - A2P Consultant- redrays.kr@gmail.com

- Mon-Sat- 08:00-19:00